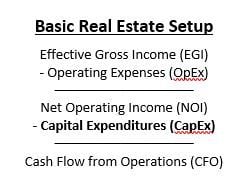

Operating expenses appear below the line on a company’s income statement. Operating expenses on an income statement OPEX are tax-deductible in the United States (for businesses that earn a profit).

You can calculate operating profit (also referred to as operating income) by deducting operating expenses from gross margin. Operating expenses are paid for with gross margin dollars. This includes advertising costs like media buying, sales commissions, as well as entertainment and travel expenses when sales reps visit clients.

Operating expenses are abbreviated “OPEX” and sometimes referred to simply as “overhead.” Operating expenses are the costs associated with running a business that are not direct ingredients or raw materials needed to make the products or services sold. OPEX does not include the cost of goods sold (COGS) or capital expenditures.Operating expenses include rent and other fixed costs, as well as variable costs for office supplies, or operating activities such as research and development expenses.Operating expenses (also called OPEX or overhead) are the amount of money a company spends on business operations.

0 kommentar(er)

0 kommentar(er)